how long does it take the irs to collect back taxes

A tax assessment determines how much you owe. After the IRS determines that additional taxes are due the IRS has 10 years to collect unpaid taxes.

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

OICs must be finalized within 2 years after the IRS receives the OIC.

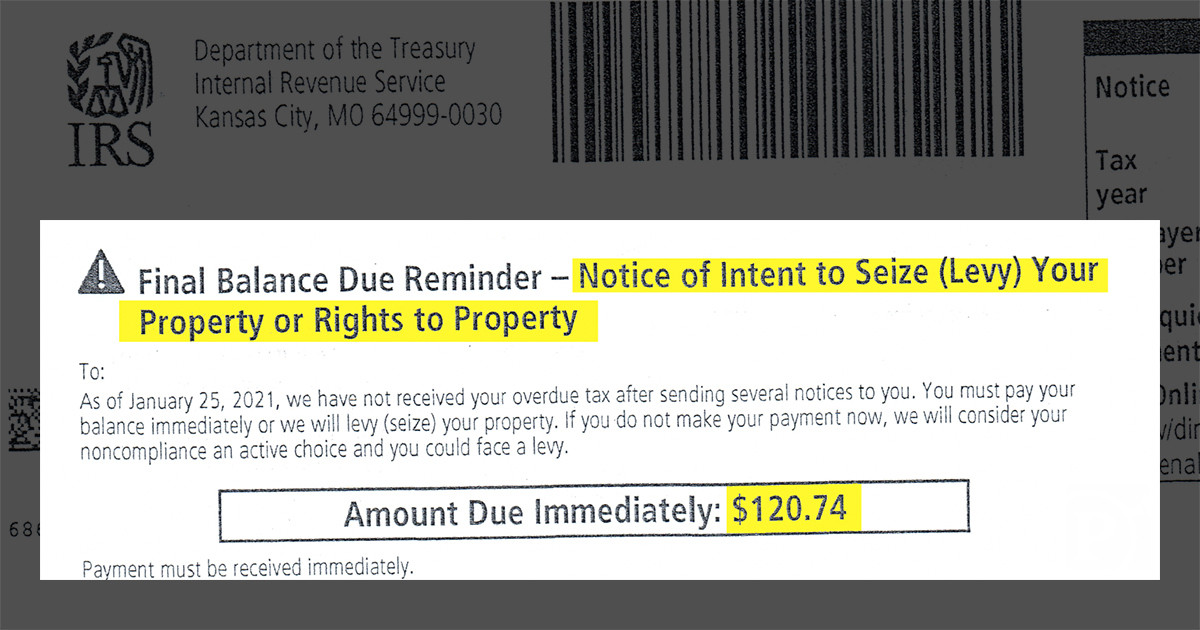

. The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment. As already hinted at the statute of limitations on IRS debt is 10 years. If you have received notice.

6 Years for Filing Back Taxes 3 Years To Claim a Refund. The IRS will provide up to 120 days to taxpayers to pay their full tax balance. How many years can the IRS go back on taxes.

There is a penalty of 05 per month on the unpaid. Most taxpayers can rest assured that after 3 years it is highly unlikely that. How long does IRS have to collect back taxes.

Louisiana property tax rates Millage rates are assigned to. This is known as the statute of limitations. In Kansas counties have been struggling with finances for years and the state has been urging property owners to pay their taxes.

If you do neither we will proceed with our proposed assessment. The tax assessment date can change. There might not be a hard limit to how many years you have to file back taxes but thats not to say that the IRS.

Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. Schedule payments up to 30 days in advance and receive instant confirmation that you submitted your payment Debit or credit card You can pay your taxes by debit or credit card. How far back can the IRS collect unpaid taxes.

You will have 90 days to file your past due tax return or file a petition in Tax Court. This means that under normal circumstances the IRS can no longer pursue collections action against you if. Theres no fee to request the extension.

During non-peak times funds are usually withdrawn on the payment date you specify assuming your e-filed return has already been accepted received by the IRS. This means that the IRS can attempt to. The 1099-K collection was last approved on January 31 2020 and is set to be re-reviewed on January 31 2023.

A 25 convenience fee is levied for credit card payments. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. As a general rule there is a ten year statute of limitations on IRS collections.

If there are substantial errors. For payment via credit card please call 1-888-272-9829. When the owner fails to pay the countys legal.

The IRS generally has 10 years from the date of assessment to collect on a balance due. After this 10-year period or statute. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. The IRS 10 year window to collect. The IRSs Supporting Statement for the information collection.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. Generally speaking when it comes to a tax audit the IRS is only able to go back three years. After that the debt is wiped clean from its books and the IRS writes it off.

If you did not file. Tax bills of more than 50000 take 7-12 months. Tax bills of less than 50000 take 4-6 months.

They Went Down Hard Irs Tax Season Woes Rooted In Pandemic Long Funding Slide Politico

Can The Irs Take Money From My Bank Account Manassas Law Group

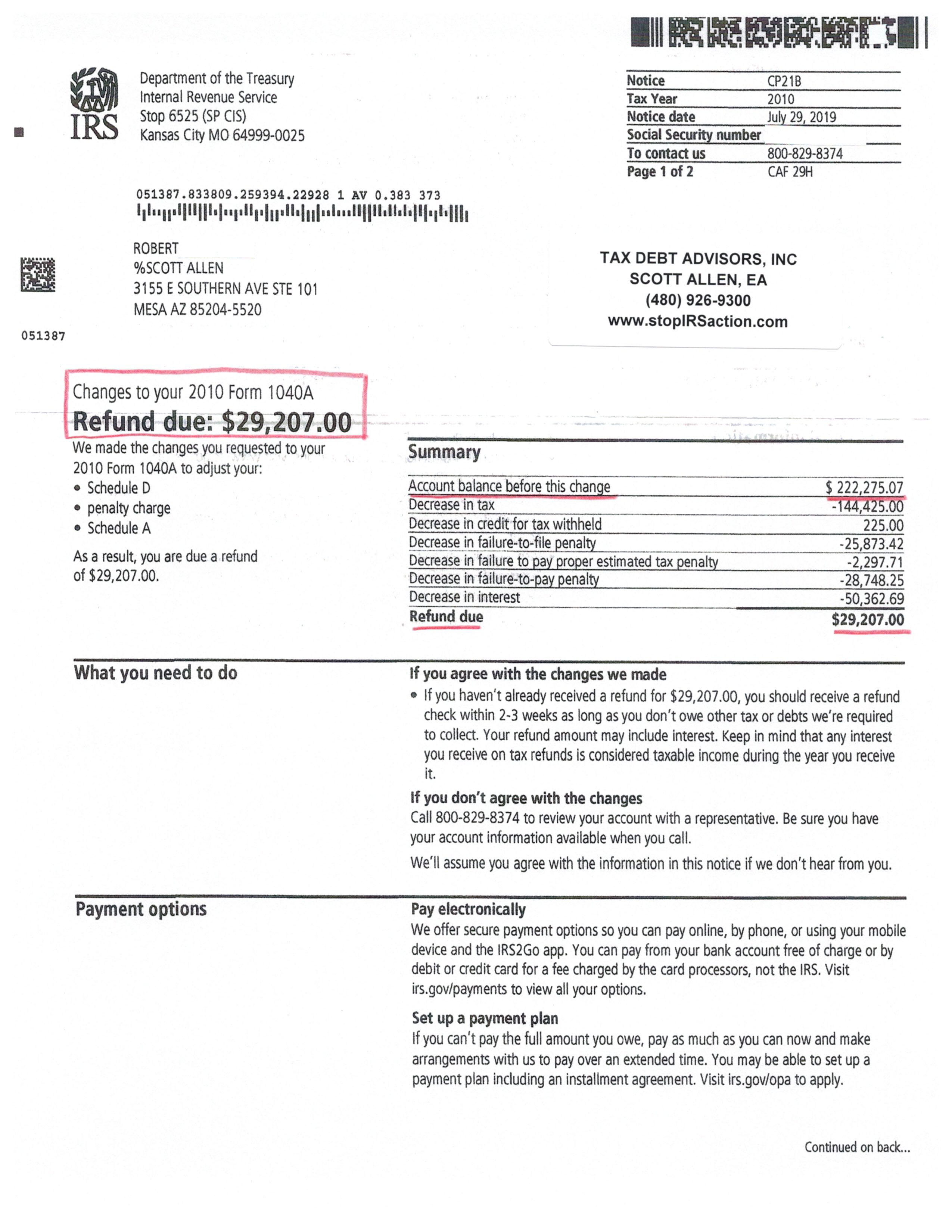

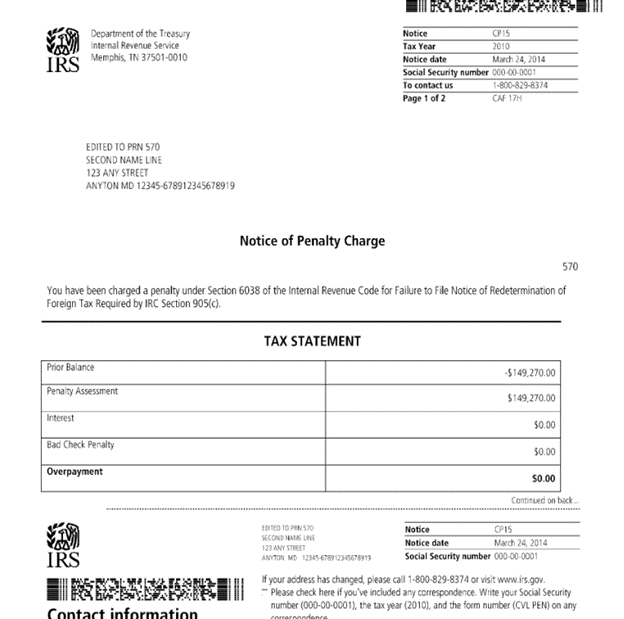

Tax Preparation Tax Debt Advisors

Opinion How To Collect 1 4 Trillion In Unpaid Taxes The New York Times

Everything You Need To Know About Irs Tax Forgiveness Programs

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

Can The Irs Take Your 401 K For Back Taxes Community Tax

How Many Years Back Can The Irs Go In Its Search For Tax Fraud West Los Angeles California Irs Lawyer Dennis Brager

How Many Years Back Can The Irs Collect Unpaid Back Taxes Wiztax

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

The Top Seven Questions About Irs Tax Transcripts H R Block

Asset Seizure What Assets Can The Irs Legally Seize To Satisfy Tax Debts

How Long Does The Irs Have To Collect Back Taxes

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

Irs Took Money From My Bank Account Louisville Bankruptcy Lawyers

Law Office Of Mary E King Pl Q Can The Irs Take My Home Or Social Security Tax Attorney Mary King Answers More Commonly Asked Questions In Her Faq Videos

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings